BUILD COMPOUNDING WEALTH TO ENSURE SUSTAINABILITY

As an investment firm, we aim to help our clients navigate through the variabilities of the capital market.

Asset Management

Portfolio diversification and management are customized and integrated uniquely for customers as it relates to their specific financial goals and situations.

INSTITUTIONAL MANAGEMENT

At MLC, we are reputable in managing your institutional and related assets, granting you access to sustainable development.

WEALTH MANAGEMENT

Wealth management is directly related to your specific financial goals and conditions. Here at MLC we help you design a strategy specific for you.

One major investment key relates to exactly what you want from life. We have wise advisors that will assist you link your life goals to your financial goals

- Creating a plan for you by understanding the best risk-reward ratio

- A diversified portfolio that balances your income and brings sustainable growth

- A financial expert that keeps constant information flowing

MLC aims to ensure sustainably prosperity between our clients and us, and as result we engage in alternative investment opportunities that benefits our clients ranging from financial planning, budgeting, automatic savings, automatic investments, portfolio diversification, among others.

Sectors

Cannabis Assets

There is a positive correlation between cannabis asset performance and that of inflation, and this makes cannabis assets a great hedge against inflation

Sectors

Real Estate

MLC understands that real estate or property is one of the best hedge for funds…

Sectors

foreign exchange

At MLC, we offer access to the global economy by capitalizing on foreign exchange (forex)…

STAKEHOLDER RELATIONS

MLC professionally manages your investment portfolios in this consistently varying bear and bull markets. Asset management techniques are designed specific for clients and finds the balance between their personal goals and volatile financial markets. This breeds confidence while investing.

is focused on creating sustainable investment strategies and platforms for managing wealth for stakeholders (investors). We build these relationships through educating clients on the psychology of investing which relates to responsible investing, customizing portfolio specific to client’s needs, innovation strategies that are proactive to the general changes of the market. This ensures healthy investor relations.

EQUITY AND INCLUSION STRATEGY

At MLC, every client has the chance to prosper irrespective of background. The discrepancies that arises from race, location, social status, gender, religion, sexual orientation and even financial abundance, etc., are all considered unimportant as we grant everyone an equal opportunity to succeed. This ensures that equity and inclusion is achieved leading to a rich bank of decision makers and community engagements.

FINANCIAL PLANNING

The importance of a plan for anything in recent times cannot be overemphasized. With so much going on in the world today, especially in the area of finances, planning will help in the minimization of many uncertainties that arises from the variableness of these times

Investment Philosophy

It’s no news that our focus is to create sustainable financial growth. This is achieved with our investment philosophy of understanding the fundamentals of the different investment niches we are handling, investing across them with this fundamental knowledge with the main goal of producing stable and consistent returns in spite of the changing cycles of the market.

CORE FOCUS

Our focus is to make strategic investments that far outweighs the turmoils of the global market. We make investments decisions on areas with strong experience and expertise on.

Culture of transparency

One major key for relationship building is transparency. partnerships never succeed without this unique quality. We share good and “bad” news to our partners and seek for better ways to go through hurdles together

COMMITTED TO CREATING BETTER LIVES FOR CLIENTS

We invest and manage assests for clients related to their financial goals via our reputable management teams and systems.

COMMERCE EXPERIENCE

Our business experience is something that will enhance the growth of partners. with a deep understanding of the dynamics of the different sectors we handle, we are equipped to creating sustainable value for partners.

DEMONSTRATED PERFORMANCE

With our clear investment philosophy, we are disciplined and have an approach to investing that is demostrated through reputable performances across multiple investment cycles

Responsible Investing

The ethics of business boils down to understanding the psychology of wealth. At MLC, we ensure that we create a platform that educates and carries out responsible and ethical investing. These are age-long principles that are unchangeable, guiding our decision making amid the variability and unpredictability of the market.

From our experience, we have learnt that the aspect of investments psychology and our inclusion strategy of working with people from diverse backgrounds and with diverse financial experiences serves as a way to curb irresponsible investing. We understand the compounding power of wealth and we seek to balance this ability with sustainability to ensure responsible investing.

We understand that among other things, governmental, social, environmental, health, and even historical issues can affect growth and investment psychology, but our partners should take solace in the fact that in addition to the rudiments of wealth creation and protection, we understand the psychology of money.

OUR ASSET MANAGEMENT SOLUTIONS

PROFESSIONALLY MANAGED INVESTMENT PORTFOLIOS

MLC professionally manages your investment portfolios in this consistently varying bear and bull markets. Asset management techniques are designed specific for clients and finds the balance between their personal goals and volatile financial markets. This breeds confidence while investing.

OUR APPROACH TO ASSET MANAGEMENT

DIFFERENT GOALS REQUIRE DIFFERENT APPROACHES

MLC understands that every investor comes with their uniqueness in financial and investments goals. Helping you select the best management methods that perfectly aligns with your goals while considering the risk involved, is one of our strengths.

To provide you additional value,

we strive to:

- Initiating and giving you the best and safest risk-reward investment opportunities related to your goals

- Minimize investment costs.

- Consistently review your goals to ensure that the best investment services are always provided.

WEALTH PLANNING

The key is understanding every dimension of your financial and life goals, and then designing a wealth plan that ensures sustainability even after retirement.

OUR VALUES

We are guided by core values which are specifically directed towards our clients, partners and investors.

STABILITY

There is no financial prosperity without stability. We ensure that our clients have can trust us and can attain certain levels of financial stability with us.

integrity

Etymologically, the word ‘integrity’ comes from the word ‘integer’, which means ‘the quality of being whole, holistic, or complete – without variableness’. We don’t compromise on our values and promises. This is the key behind our results, we get them by integrity.

results

We consistently strive to deliver quality results to our partners in all areas, even beyond investments

knowledge

The various niches we cover demands that we possess a holistic knowledge of vast majority of areas to drive growth. We never assume we know all there is in this ever-changing world of finance, but we possess the quality to adapt and pursue better paths to success. This quality alone surpasses any existing knowledge we have.

Sector

FIXED INCOME

MLC can give beneficial advice for asset allocation by in fixed income funds by understanding the financial goals, age, risk appetite, etc

MULTI ASSETS

MLC has a major goal of advising partners on how to save and invest; going ahead to manage the investments of our clients and partners. We will outline the diverse methods by which equity investments can be diversified

STOCKS

We help you pick the right stocks and invest in them based on growth or value strategies related to your financial goals

What we do

Diversify your portfolio to align with your life and career goals

Identify the risks involved related to your investments and create a system to sustain your wealth even until retirement

Analyze your current net worth, current and future needs a goals

Help you identify the best opportunities to maximize profit through optimizing your investment strategies by understanding your goals and proper risk management

Present wealth sustainability and wealth transfer methods that align with your wishes

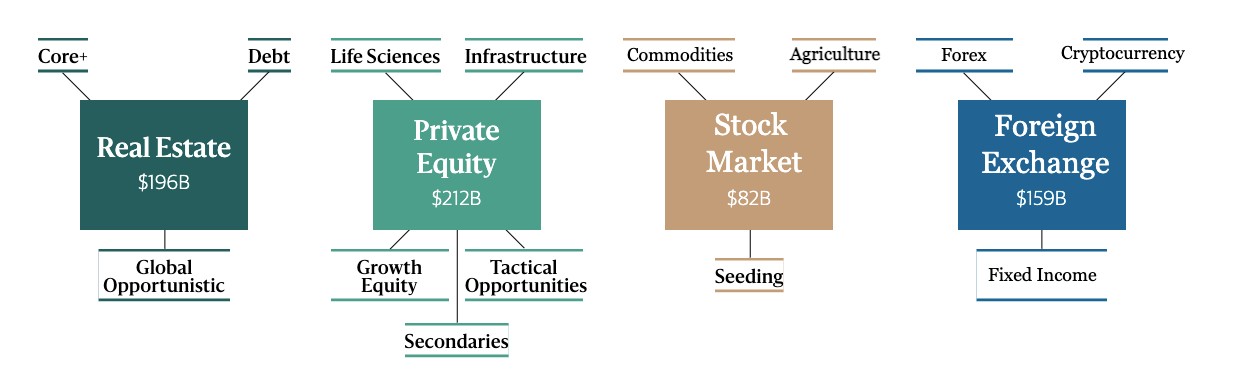

ACTIVE MANAGEMENT ACROSS ASSET CLASSES

MLC offers asset management across various profitable asset classes with the aim of create a stable portfolio, minimize risk arising from various market volatility, etc.; all on a global level.

how we work

COMPETENT TEAM

MLC is highly built on excellence. With knowledge being one of our values, we have and work with competent teams and group who use their diverse skills to achieve common goals. This allowance helps in focusing our actions for better results

COOPERATIVE STYLE

We understand the importance of “social capital” as a key factor for holistic development. We encourage different people and partners from different niches to invest with us. We regularly find better ways to create a win-win situation for our partners

ALIGNMENT OF INTEREST

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships.

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

Our Purpose

Our purpose is to give clients and partners a sense of security with their personal economy, whilst not trivializing the effect of the national and global economy on their personal finances. This ensures a balanced and reasonable risk-appetite level, and in extension, significant returns

Environment

Our Buyout Funds’ portfolio can be qualified as ‘asset light’ and the most material environmental indicator for many companies is electricity usage.

Social

Processes and practices are in place across the portfolio to support the wellbeing of the workforce.

Environment

Our Buyout Funds’ portfolio can be qualified as ‘asset light’ and the most material environmental indicator for many companies is electricity usage.

LIVE LONGER, BETTER.

What is long-term care? Long-term care is something that most people may not think they need, or might think is covered by health insurance or Medicare. The fact is, if you live to be 65, there’s a 70% chance you’ll eventually need some kind of long-term care.1 But aging isn’t the only reason to plan for long-term care—it’s there for you if a chronic illness or disabling injury prevents you from living on your own or properly caring for yourself, no matter how old you are. Long-term care helps with day-to-day tasks like bathing, eating,

getting dressed, and getting in and out of bed. And it includes care provided by nursing homes, assisted living facilities, adult day care centers, hospice facilities, and skilled nurses or home health aides in your (or your loved one’s) home. If you’re not the one who needs it, there’s a good chance you’ll need to help care for a loved one.2 And having a long-term care plan in place can help you continue to live well without sacrificing the income, investments, and savings you’ve worked so hard for.

OUR PEOPLE

We focus on attracting exceptionally talented people and rewarding initiative, independent thinking and integrity. Our team’s breadth of skills and deep expertise are a critical source of intellectual capital.

OUR SCALE

Investing across regions, industries and asset classes gives us the knowledge, resources and critical mass to take advantage of opportunities on a global scale.

OUR PERFORMANCE

Our performance is characterized by superior risk-adjusted returns across a broad and expanding range of asset classes and through all types of economic conditions.

Maxloz Capital scale creates unique opportunities for revenue acceleration. Access to our network of portfolio companies helps entrepreneurs grow their customer base and make connections across a range of industries and geographies. An in-house team of data scientists helps our companies’ management teams optimize revenue and product development opportunities. In addition, our global footprint can support our companies’ expansion across the world’s major economies

Maxloz Capital scale creates unique opportunities for revenue acceleration. Access to our network of portfolio companies helps entrepreneurs grow their customer base and make connections across a range of industries and geographies. An in-house team of data scientists helps our companies’ management teams optimize revenue and product development opportunities. In addition, our global footprint can support our companies’ expansion across the world’s major economies

BLOG

OUR LATEST NEWS

Testimonials

About Us

MLC has the sole purpose of making our clients not just financially free, but also psychologically relaxed in the midst of obvious global economic turmoil.

investment Products

Social Media

Risk Reminder: Trading foreign exchange and/or contracts for differences on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could sustain a loss in excess of your deposited funds. Before deciding to trade the products offered by Maxloz Capital. You should carefully consider your objectives, financial situation, needs and level of experience. You should be aware of all the risks associated with trading on margin. Maxloz Capital provides general advice that does not consider your objectives, financial situation or needs. The content of this Website must not be construed as personal advice. Maxloz Capital recommends you seek advice from a separate financial advisor.